Revealing the Insurance Landscape: An All-Inclusive Insurify Comparison

First Of All,

When it comes to safeguarding their possessions and welfare, consumers have a plethora of options in the constantly changing insurance market. Insurify is one platform that has drawn a lot of interest. Insurify, a cutting-edge participant in the insurance comparison market, claims to make the sometimes difficult process of selecting the appropriate insurance coverage easier. We will examine the distinctive qualities of Insurify, contrast them with conventional approaches, and consider how this platform is influencing the direction of insurance in this blog article.

Knowing How to Insurify

Insurify is a disruptive force in the insurance sector, not just another comparison website. The platform analyzes enormous volumes of data and generates customized insurance estimates based on user demands by utilizing cutting-edge artificial intelligence and machine learning algorithms. This is different from conventional approaches that use human data entry and comparison.

Interface That’s Easy to Use:

The intuitive UI of Insurify is one of its best qualities. The platform is easy to use, enabling customers to quickly enter their information and get precise insurance rates in a couple of minutes. It is accessible to a wide range of users because of its user-friendly design, which suits both tech-savvy users and those who might not be as comfortable with online platforms.

Precision and Effectiveness:

Using state-of-the-art technology, Insurify can provide insurance quotations with more accuracy and efficiency. Conventional approaches frequently entail protracted questionnaires and the possibility of human mistakes, which could result in erroneous quotes. Numerous criteria are considered by the Insurify algorithm, which results in a more accurate assessment of coverage requirements and expenses.

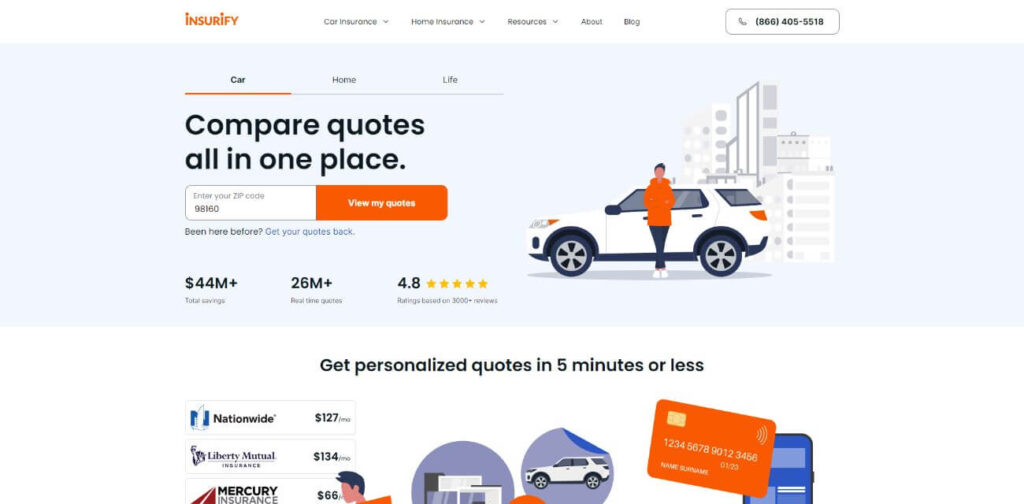

Comparing Different Coverage Options

Insurify offers a thorough summary of coverage alternatives in addition to streamlining the comparison process. Comparing policies from different insurance companies is simple for users, who may take exclusions, deductibles, and coverage limits into account. This openness gives customers the power to choose their insurance coverage wisely, something that traditional approaches sometimes lack.

Specific Suggestions:

Delivering customized insurance advice is the core of Insurify’s innovation. The platform uses artificial intelligence (AI) to evaluate user input and preferences and recommend policies that best suit each user’s needs. Insurify’s tailored approach distinguishes it from conventional approaches, which frequently have a one-size-fits-all mindset.

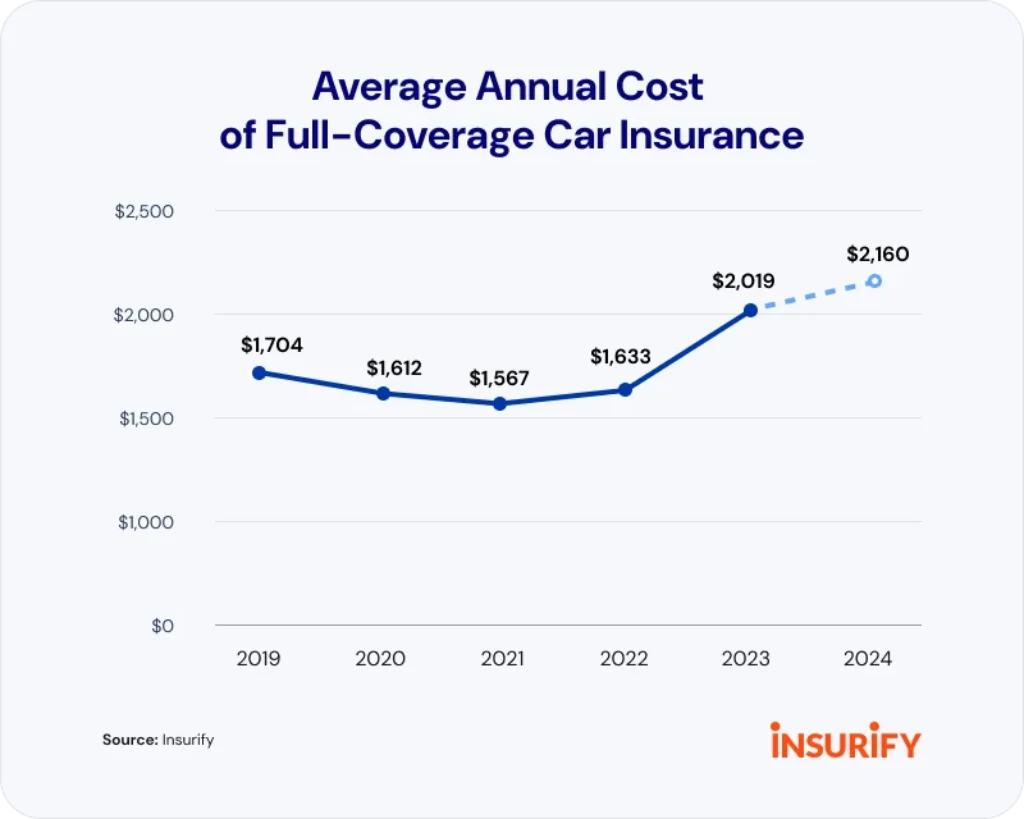

Savings on costs:

Cost is a major factor that people take into account when purchasing insurance. Thanks to Insurify’s technology, users may choose affordable solutions without sacrificing coverage. Through the simplification of the comparison process and the removal of superfluous middlemen, Insurify helps policyholders potentially save money.

Client Feedback and Contentment:

It’s critical to comprehend other users’ actual experiences while choosing an insurance company. By integrating customer evaluations and satisfaction ratings into its platform, Insurify provides insightful information that goes beyond the conventional recommendations from friends and family. This feature improves user experience and increases confidence in the process of making decisions.

In Summary:

As we negotiate the always-evolving insurance industry, websites such as Insurify stand out as trailblazers in transforming the way we protect our assets. Accuracy and customization are guaranteed, and the comparison process is made easier by the smooth integration of AI and machine learning. Even while conventional approaches have worked well in the past, adopting technological innovations that make insurance more accessible, effective, and customized to individual needs is surely necessary for the industry’s future. The future of insurance appears bright, with Insurify setting the standard and ushering in a new era of customer ease and openness.